talent intelligence

precision sourcing

My sourcing begins with Talent Intelligence. I analyze global talent flows, economic shifts, political climates, workforce signals and cultural dynamics to understand where skills emerge, how they evolve, and why they move.

By mapping these patterns, I can target prospects with precision and predict where the next wave of AI/ML talent will surface.

→ It’s not just about filling roles, it’s about being positioned at the edge of innovation to capture massive value.

Proactive acquisition strategies for AI/ML talent.

precision closing

Every behavioral cue and data point shapes how I build candidate relationships. I study motivation via psychology, observing patterns to understand each person’s decision-making triggers and emotional drivers.

I’m not selling a job; I’m aligning opportunity with intrinsic motivation, values, and timing.

→ Top-tier talent make career moves when identity, purpose, and autonomy align. My approach connects mission to mobility, transforming behavioral data into genuine connection.

Global Pipelines, Local Clusters

Figure 1

Figure 2

Figure 3

insights

01: Source Across Borders, Not Just Titles

Nearly 40% of top AI researchers in U.S. institutions were educated abroad, primarily in China and India. Tracking the global mobility of key researchers crossing borders leads to gold. They’re the unicorns driving knowledge transfer and innovation pipelines.

02: Follow the bridges

While China produces much of the world’s AI research talent, the US retains a majority of them. The opportunity lies in sourcing from these global professionals with bicultural and bi-technical fluency who act as bridges between ecosystems.

03: Elite Talent Converges, Not Disperses

At the highest levels (top 2%), elite AI researchers overwhelmingly cluster in the U.S. This consolidation means frontier innovation is network-based, not geographic. The sourcing edge comes from mapping who collaborates with whom. It’s all about the relational web behind the resumes.

(Figure 1, Figure 2, Figure 3)

identifying frontier innovators

Figure 4

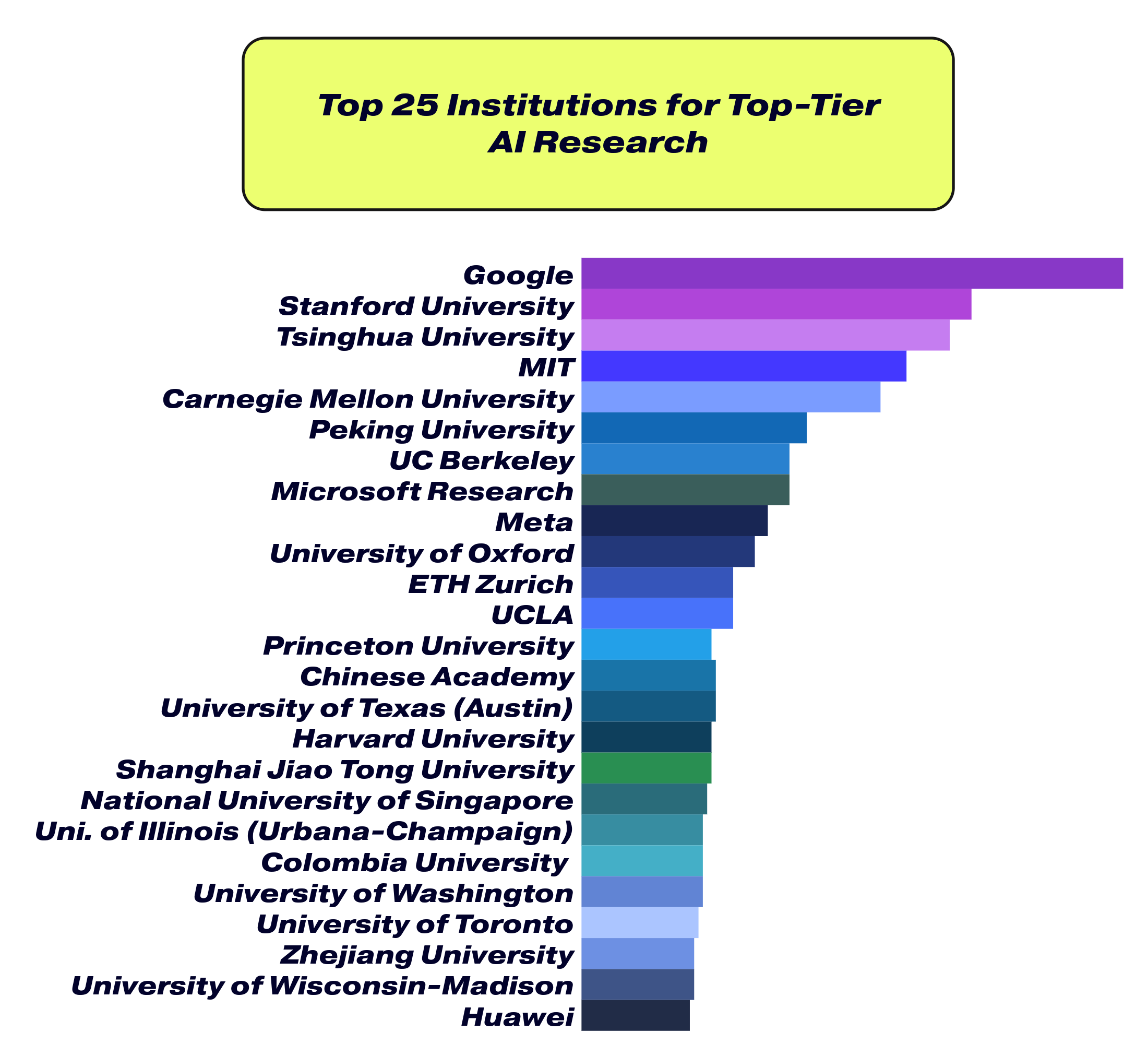

01: Source at the Source

Targeting soon-to-be graduates and researchers at these AI institutions is foundational. Engaging at key transition points, such as thesis completions, publications, and conferences when mobility peaks is step #1.

02: Source the Periphery

Mapping collaboration networks around elite labs yields high ROI. Co-authors and partner engineers often match top-tier expertise without the hiring saturation.

03: Follow the Cross-Pollinators

Prioritizing talent moving between academia, big tech, and startups is key. These hybrid pros turn cutting-edge research into scalable product innovation.

(Figure 4)

insights

Emerging NextGen Builders

Figure 5

01: Build Early Pipelines

Ongoing engagement with students, research assistants, and fellowship programs at these universities is key. Early relationship-building within top AI departments creates access to emerging technical talent before they enter the broader market.

02: Leverage Regional Ecosystems

Many of these universities sit near major tech hubs—Bay Area, Austin, Seattle, Atlanta. I source locally to tap into tight alumni networks, higher retention rates, and built-in mobility between campus and industry.

03: Track Alumni Migration

I constantly document where graduates land after their first or second roles. These alumni become the connective tissue between academia, big tech, and startups—ideal nodes for referrals, introductions, and second-wave hires.

(Figure 5)

insights

Builders Translating AI Into Industry

Figure 6

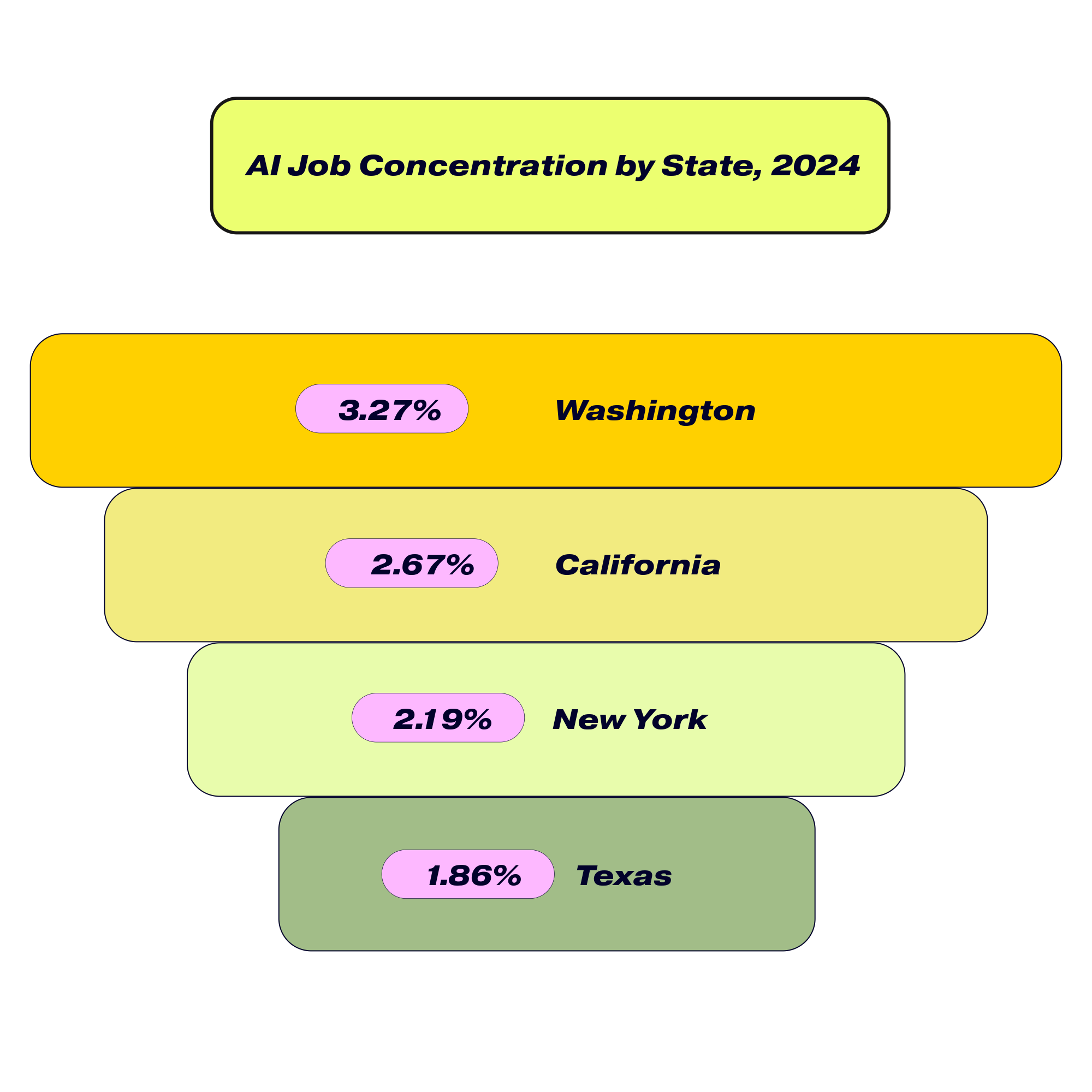

01: Washington Leads in Density

Seattle’s ecosystem creates a deep but competitive hiring market—ideal for targeting specialized, industry-ready talent.

02: California Holds Scale, Not Saturation

California has broad distribution across roles and industries, offering a huge opportunity to source niche AI talent outside Silicon Valley’s hiring bottlenecks.

03: Emerging Corridors Show Momentum

AI professionals emerging from markets like Texas and New York specialize in integration over invention. My sourcing switches up from targeting labs to targeting refineries, data centers, and supply chain hubs.

(Figure 6)

insights

Reading Between the Lines of Market Share

Figure 7

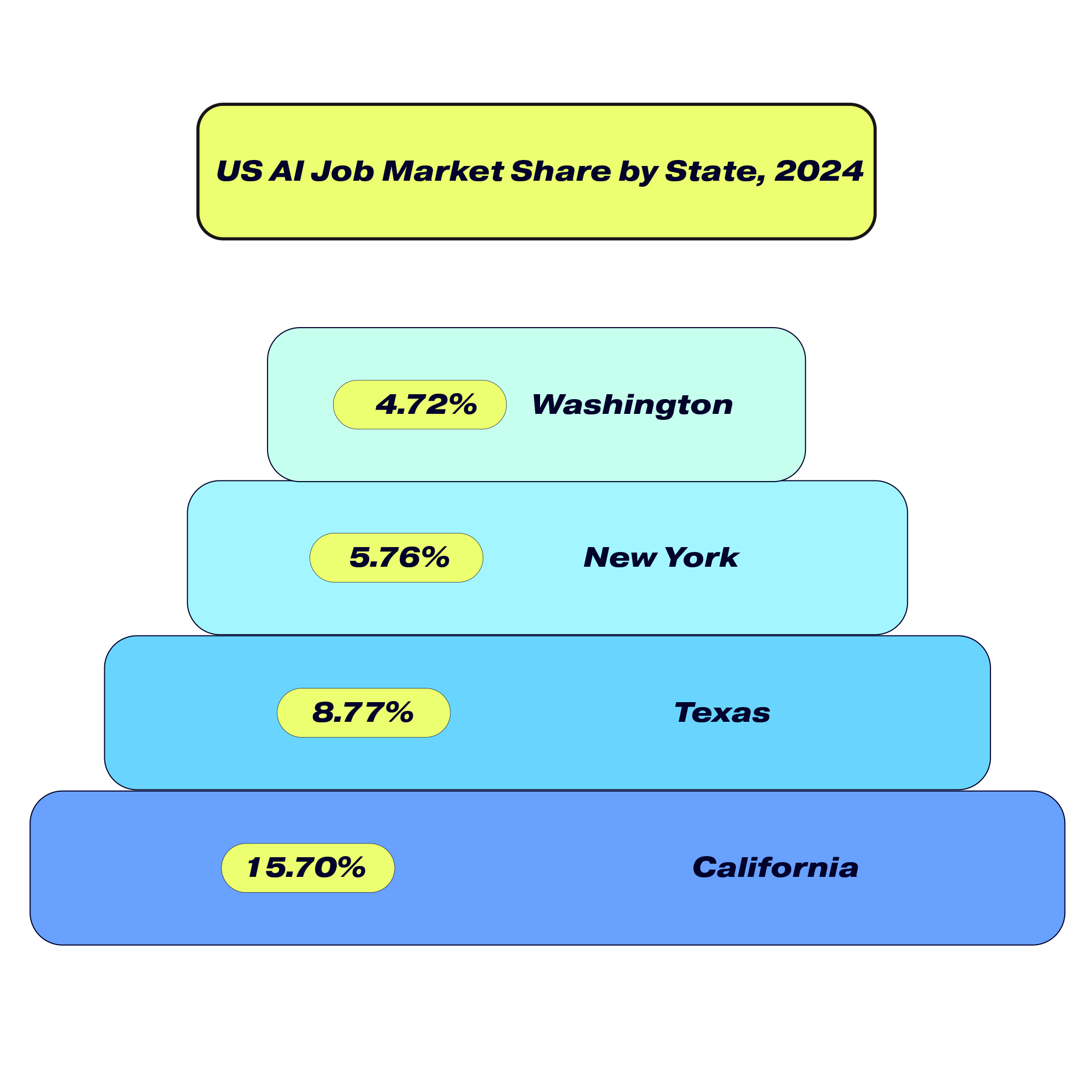

01: Market Share Signals Employer Power

CA dominates AI hiring, conditioning candidates to negotiate from abundance. My outreach strategy here focuses on mission and differentiation, not compensation, because top talent already has leverage.

02: Expansion Markets Create Adaptive Talent

Unlike entrenched ecosystems, Texas and New York’s growing AI markets demand versatility. Their professionals work across functions developing cross-disciplinary skill sets that outperform narrow expertise.

03: Low-Share States Offer Retention Advantage

Smaller markets like Washington foster tight-knit ecosystems where relationships and community matter more than perks. Sourcing here is about belonging. This hub is ideal for sourcing stable, culture-first talent.

(Figure 7)

insights

Closing the Gender Gap in AI

Figure 8

01: Unlock Untapped Talent Pools

Women make up only ~22–30% of the global AI workforce. Actively engaging confident female technologists, especially at early career inflection points, creates a lasting competitive advantage.

02: Female Skills = Resilience in Disruption

Women remain significantly underrepresented in senior AI roles. Shocker. Roles designed to offer visibility, leadership, and meaningful impact resonate most. Structuring outreach around autonomy and influence attracts high-potential women navigating bias and transition.

03: Inclusive Sourcing Builds Innovation Equity

Gender diversity isn’t just ethical, it’s strategic and necessary. Diverse AI teams build more robust systems and avoid narrow assumptions. Inclusive sourcing strengthens both innovation and long-term talent equity which is why it’s a top priority of mine.

(Figure 8)

insights

Where Frontier Talent Converges

Figure 9

01: The Compression of Expertise

The best scientists and engineers are specializing into micro-domains. My sourcing edge is finding talent density through strategic qualification.

02: Applied Research Is the New Currency

Generative AI and NLP are where academic theory now monetizes. The line between “researcher” and “engineer” is collapsing as AI talent today builds while they publish. The real opportunity isn’t only in hiring scientists; it’s in sourcing builder-researchers who can ship code and cite papers in the same week.

03: Optimization Is the Hidden Layer

Optimization talent is invisible in job postings but critical in performance outcomes. These profiles rarely label themselves “optimization engineer.” They hide behind titles like ML Infrastructure, Systems Performance, or Applied Scientist. Luckily, I speak their language.

(Figure 9)

insights

Figure 1. “Leading Countries Where the Most Elite AI Researchers Work (Top ~2%).” The Global AI Talent Tracker. Paulson Institute, 2023.

Figure 2. “Leading Countries Where Top-Tier AI Researchers Work (Top ~20%).” The Global AI Talent Tracker. Paulson Institute, 2023.

Figure 3. “Leading Countries of Origin of Top-Tier AI Researchers Working in U.S. Institutions (Top ~20%).” The Global AI Talent Tracker. Paulson Institute, 2023.

Figure 4. “Top 25 Institutions for Top-Tier AI Research.” The Global AI Talent Tracker. Paulson Institute, 2023.

Figure 5. “Top 10 AI/ML Talent-Producing Universities in the U.S.” Artificial Intelligence Index Report 2025. Stanford Institute for Human-Centered Artificial Intelligence (HAI), 2025.

Figure 6. “AI Job Concentration by State, 2024.” Artificial Intelligence Index Report 2025. Stanford Institute for Human-Centered Artificial Intelligence (HAI), 2025.

Figure 7. “U.S. AI Job Market Share by State, 2024.” Artificial Intelligence Index Report 2025. Stanford Institute for Human-Centered Artificial Intelligence (HAI), 2025.

Figure 8. “Global AI Talent Representation, 2024.” Artificial Intelligence Index Report 2025. Stanford Institute for Human-Centered Artificial Intelligence (HAI), 2025.

Figure 9. “AI Job Concentration by State, 2024.” The Future of Jobs Report 2025. World Economic Forum, Jan. 2025.